San Fernando Valley Real Estate Market Report 📊 — Mid-2025

Market Overview

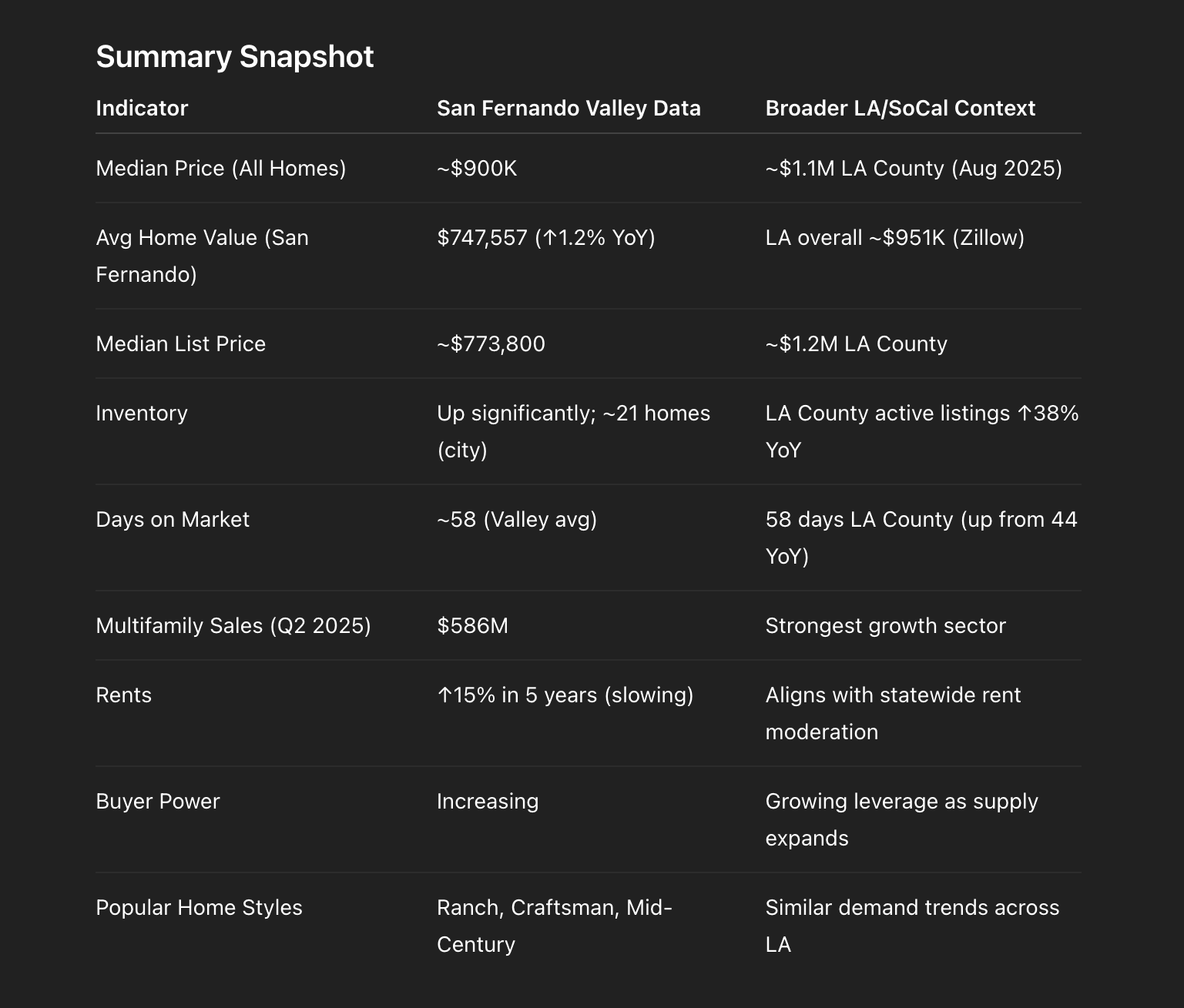

The San Fernando Valley real estate market is shifting toward balance, with prices holding near $900,000 and growth moderating. Rising inventory is giving buyers more options, while steady sales—especially in multifamily—signal ongoing confidence despite longer days on market.

Market Snapshot

The San Fernando Valley is showing mixed but dynamic trends in mid-2025. Prices remain high, inventory is rising, and multifamily sales are fueling activity, all while the market edges closer to balance.

Median Home Price: ~$900,000 (Facebook/local pro data).

Zillow Avg Home Value (San Fernando city): ~$747,557 (↑1.2% YoY).

Median List Price: ~$773,800 (Zillow, June 2025).

Median Sold Price Condos/Townhomes: ~$679,000 (July 2025, countywide).

Inventory: ~21 homes for sale in San Fernando city; Valley-wide inventory up significantly, with some areas reporting triple the listings compared to earlier in the year.

Mortgage Rates: ~6.7% (30-yr fixed, Aug 2025).

Key Trends

Home Prices & Growth

Median Valley Price: ~$900K (Aug 2025).

Price Gains Vary by Size: Larger homes (5+ bedrooms) are seeing bigger gains, while smaller homes show more modest growth.

Moderating Growth: Price increases are slowing compared to the rapid run-up of past years.

Style Preferences: Traditional ranch homes, Craftsman bungalows, and mid-century moderns remain popular.

Inventory & Buyer Leverage

Inventory has risen sharply, with certain neighborhoods seeing almost triple the listings vs. early 2025.

Buyers now enjoy more options and negotiating power, with homes staying longer on market (Valley averages aligning with LA County’s ~58 days on market vs. 44 days last year).

Expect sellers to adjust with more realistic pricing and stronger marketing strategies.

Sales Activity & Multifamily Surge

Q2 2025 Multifamily Sales: $586 million in transactions — proof of investor confidence and steady demand in rental housing.

Bidding Wars: Still active in prime or well-priced properties, though more localized.

Retail Market: Steady with slightly higher availability rates and minimal new construction.

Rental Market

Rents are up ~15% over the past five years, but growth is slowing in 2025.

This trend supports strong demand for multifamily properties and steady investor activity.

Regional & Broader Context

Southern California overall saw its first YoY home price dip since 2023 (-0.2% in May, ~$876K average).

LA County active listings up 38% YoY, adding momentum to a more balanced market.

Days on Market: up ~43% YoY regionwide; typical pending ~30 days.

Wildfire Risk: Still a factor in hillside/edge neighborhoods — insurance and rebuild concerns continue to affect certain buyers.

Summary Snapshot

Looking Ahead

Prices: Expect modest appreciation through 2025 (low-single digit growth), with larger homes outperforming smaller ones.

Inventory: Likely to remain higher, shifting leverage toward buyers.

Multifamily Sector: Remains strong — steady rent demand + $586M in Q2 deals signal ongoing investor interest.

Buyers: More choices, stronger position to negotiate concessions and closing costs.

Sellers: Need to price strategically, stage professionally, and market aggressively to compete in a more balanced environment.