Los Angeles Real Estate Market Report 📊 — Mid-2025

Market Overview

The Los Angeles real estate market is transitioning from the frenzy of past years into a more balanced environment. Prices remain among the highest in the nation, but demand is softening, sales are moderating, and buyers are starting to gain leverage.

Key Trends

Cooling Demand & Sales Moderation 🔻

Buyer interest has softened, and sales are easing.

Still, sales in the Los Angeles Metro Area jumped 23.5% from February to March 2025, before tapering slightly in subsequent months.

Market activity remains positive year-over-year, but the pace is slowing compared to the post-pandemic boom.

Price Appreciation, but Slower

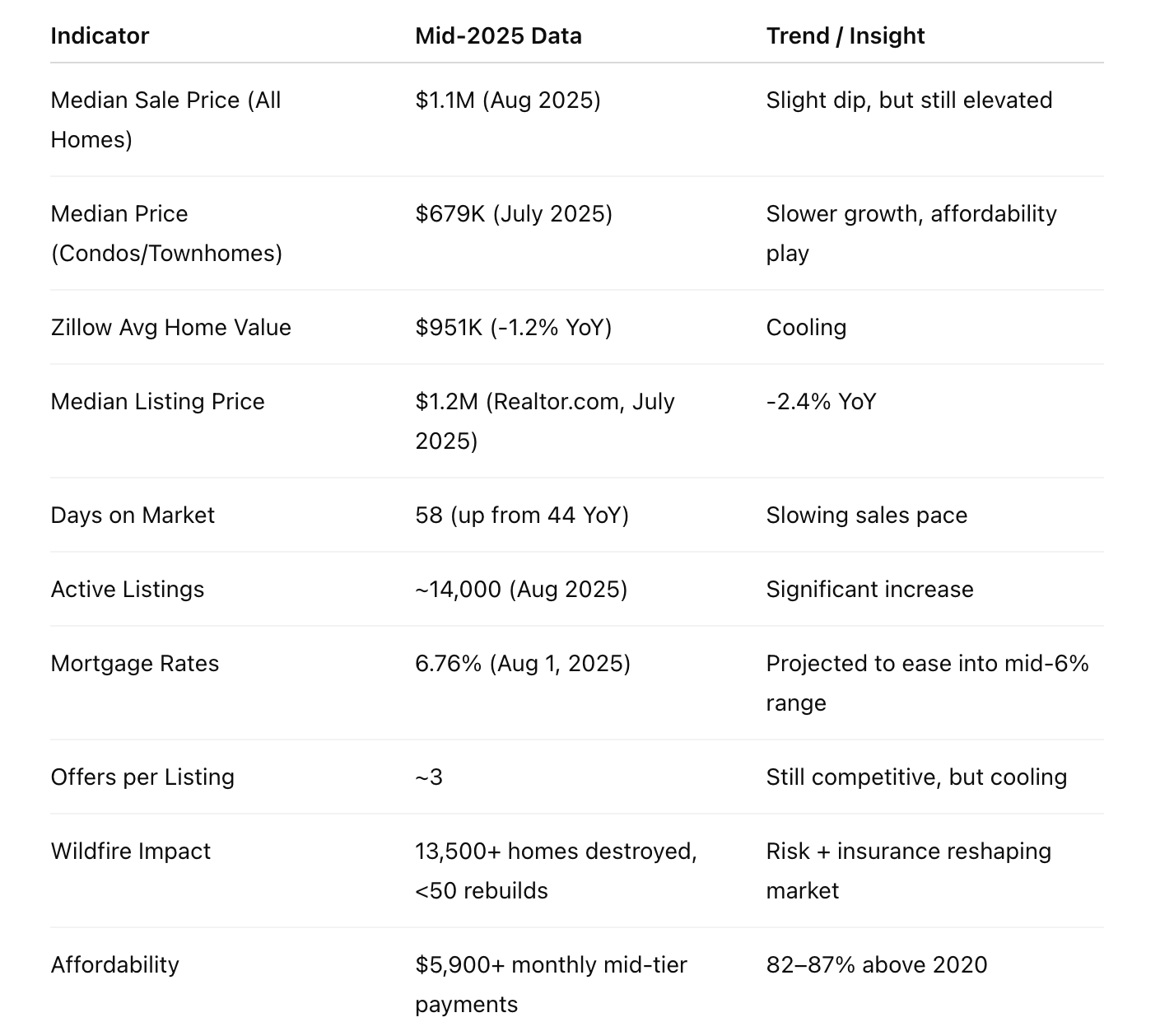

Median sale price (Aug 2025): $1.1M.

Prices are still high but growth is moderating, with a slight dip reported in August.

Condos/Townhomes median price: $679,000 (July 2025).

Across major trackers:

Zillow: ~$951K (-1.2% YoY).

Redfin: ~$1.058M (-1.6% YoY).

Realtor.com: ~$1.2M (-2.4% YoY).

Inventory Rising

14,443 active listings in March 2025; ~14,000 homes for sale as of August.

This represents a significant YoY increase, giving buyers more choice.

Homes Taking Longer to Sell

Average Days on Market: 58 (up from 44 last year).

Homes typically go pending in 28–30 days per Zillow/Redfin, but countywide averages are higher, showing a cooling trend.

Buyer Leverage Increasing

More inventory + longer market times = buyers have more negotiating power.

Expect stronger demand for concessions, repairs, and closing cost credits in certain price bands.

Mortgage & Affordability Snapshot

30-Year Fixed Rate (Aug 1, 2025): 6.76%.

Forecasts suggest rates could stabilize in the mid-to-low 6% range by year-end.

Typical mid-tier homebuyer payments in CA remain $5,900+/month, nearly 82% higher than 2020. Bottom-tier homes: ~$3,600/month (+87% since 2020).

Affordability is strained, fueling creative financing strategies, cash buyer interest, and pressure on policymakers.

Wildfire & Insurance Pressures

January 2025 wildfires destroyed 13,500+ properties, with <50 rebuild permits issued in LA County by May.

Nearly 1.3M CA homes sit in very high wildfire risk zones.

Sales in these high-risk areas dropped 7.9% in May 2025, despite prices rising 2.9%.

Insurance hurdles and resilience planning are now key buyer/seller considerations.

Looking Ahead

Moderating Prices: Expect modest appreciation (~3–4%) into 2026.

Easing Mortgage Rates: Rates could dip into the mid-6% range.

Stable but Competitive: LA will remain highly desirable, but realistic pricing and strategic negotiation will define success.

Implications

🏡 For Buyers

More leverage: More listings and longer market times open room for negotiation.

Shop around for rates, secure pre-approval, and be ready to act quickly on well-priced homes.

Watch wildfire risk zones carefully—insurance can make or break affordability.

🏡 For Sellers

Realistic pricing is non-negotiable. Overpricing risks stalling in a market that now favors buyers.

Strategic marketing (staging, video, social media presence) is critical to stand out.

Consider cash/as-is buyers if repairs are needed, or explore programs like NextHome Refresh to maximize value before listing.